Mini

The Sensex and the Nifty50 declined half a % every within the first jiffy of commerce after a muted begin. Globally, nervousness persevered amongst traders amid recession warnings from the IMF and the World Financial institution, and a key fee determination within the US due this week.

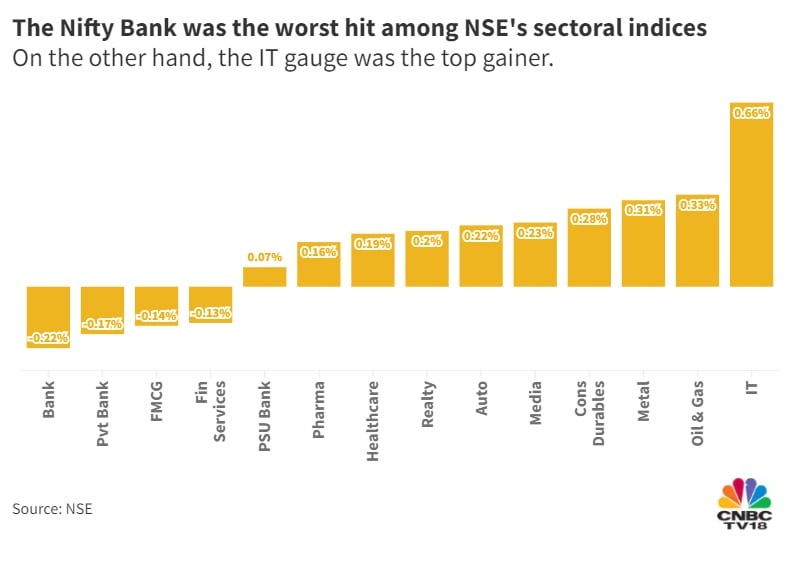

Indian fairness benchmarks started the buying and selling week on a lacklustre word amid fears of recession and nervousness forward of a widely-expected 75-basis-point hike in the important thing US rates of interest this week. Losses in monetary and FMCG shares put stress available on the market, although positive aspects in IT shares restricted the draw back.

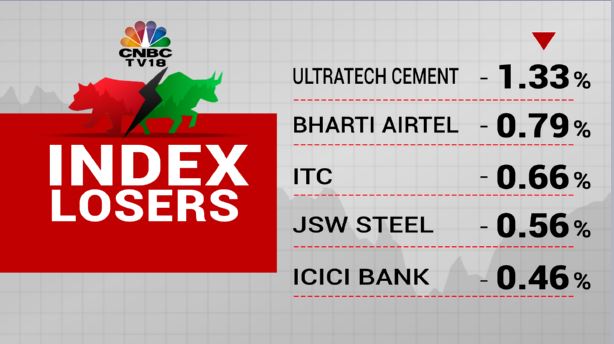

A complete of 25 shares within the Nifty50 basket started the day within the pink. UltraTech, Bharti Airtel, ITC, JSW Metal and ICICI Financial institution have been the highest laggards.

Kotak Mahindra Financial institution, Grasim, HDFC Financial institution, Tata Motors and SBI — opening as much as 0.4 % decrease — have been additionally among the many worst-hit blue-chip shares.

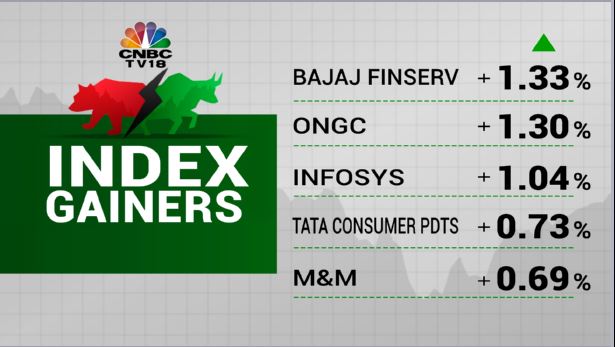

Alternatively, Bajaj Finserv, ONGC, Infosys, Tata Client and Mahindra & Mahindra have been the highest gainers.

Wipro, HDFC Life, Bharat Petroleum, Hindalco and UPL have been additionally among the many main shares that rose essentially the most.

ICICI Financial institution, Asian Paints, Kotak Mahindra Financial institution and Reliance have been the largest contributors to the autumn in each most important indices.

“The market is more likely to take a decisive development solely after the Fed coverage announcement on September 21,” mentioned VK Vijayakumar, Chief Funding Strategist at Geojit Monetary Providers.

“The near-term texture has turned weak and a ‘purchase on dips’ technique is unlikely to work within the current risk-off international atmosphere. FIIs turning sellers is a short-term unfavorable,” he mentioned.

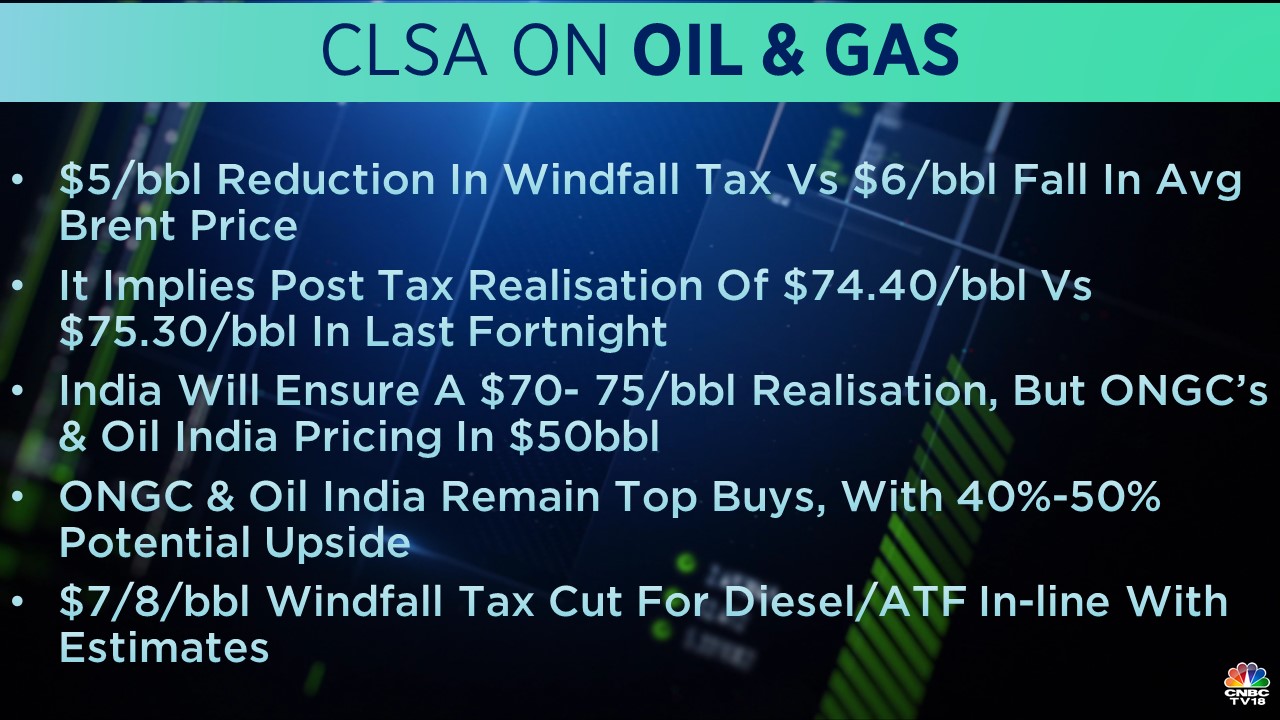

ONGC shares rose after the federal government final week lower a windfall tax on domestically-produced crude oil in keeping with a fall in international charges.

India’s prime oil and fuel producer desires the federal government to scrap the tax and use the dividend route as an alternative to faucet into bumper earnings ensuing from the spike in power costs this 12 months.

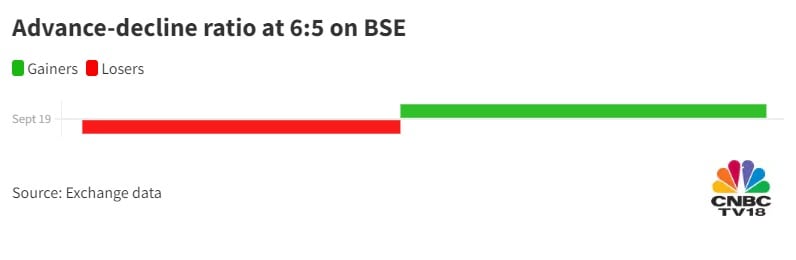

Total market breadth was in favour of the bulls, as 1,620 shares rose and 1,408 fell on BSE in early offers.

World markets

Equities in different Asian markets have been largely within the pink following two-month lows on Dalal Road amid recession warnings from the IMF and the World Financial institution. Nervousness additionally persevered as traders awaited a key fee determination by the Fed this week.

MSCI’s broadest index of Asia Pacific shares outdoors Japan was down 0.5 % on the final depend. Hong Kong’s Dangle Seng was down 0.8 % and China’s Shanghai Composite flat. The Japanese market was shut for a vacation.

S&P 500 futures edged down 0.2 %, suggesting a sluggish begin forward on Wall Road.

Disclaimer: Network18, the dad or mum firm of CNBCTV18.com, is managed by Unbiased Media Belief, of which Reliance Industries is the only real beneficiary.